Reflexivity, Leverage, and the Rise of the On-Chain Dollar

From options reflexivity to on-chain dollars: how leverage, liquidity, and geopolitics are reshaping market stability.

Hello everyone,

I think this is a great moment to revisit the topic of market reflexivity — especially how derivative flows shape short-term price action. Markets rarely move in straight lines. Instead, they bounce between positioning, liquidity dynamics, and shifting incentives.

1) Options reflexivity is doing more of the steering than many realize

If you’ve followed my work, you know I pay close attention to the monthly options expiration (“OPEX”) dynamic - especially around the third Friday each month—because large imbalances between puts and calls can mechanically push prices around.

When panic pushes investors toward protection, market makers hedge. When panic outweighs real moves that hedging itself can drive prices in the opposite direction.

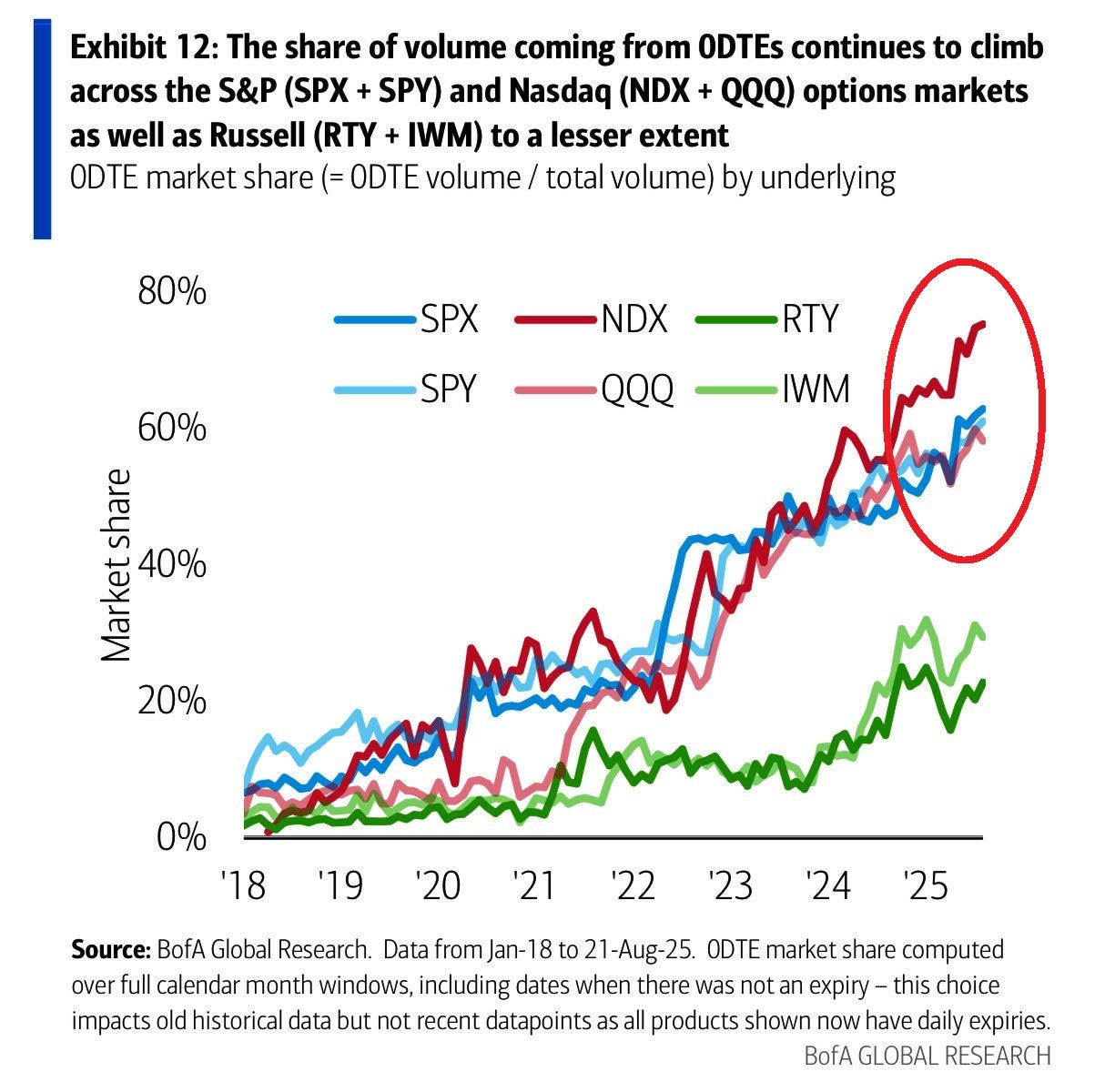

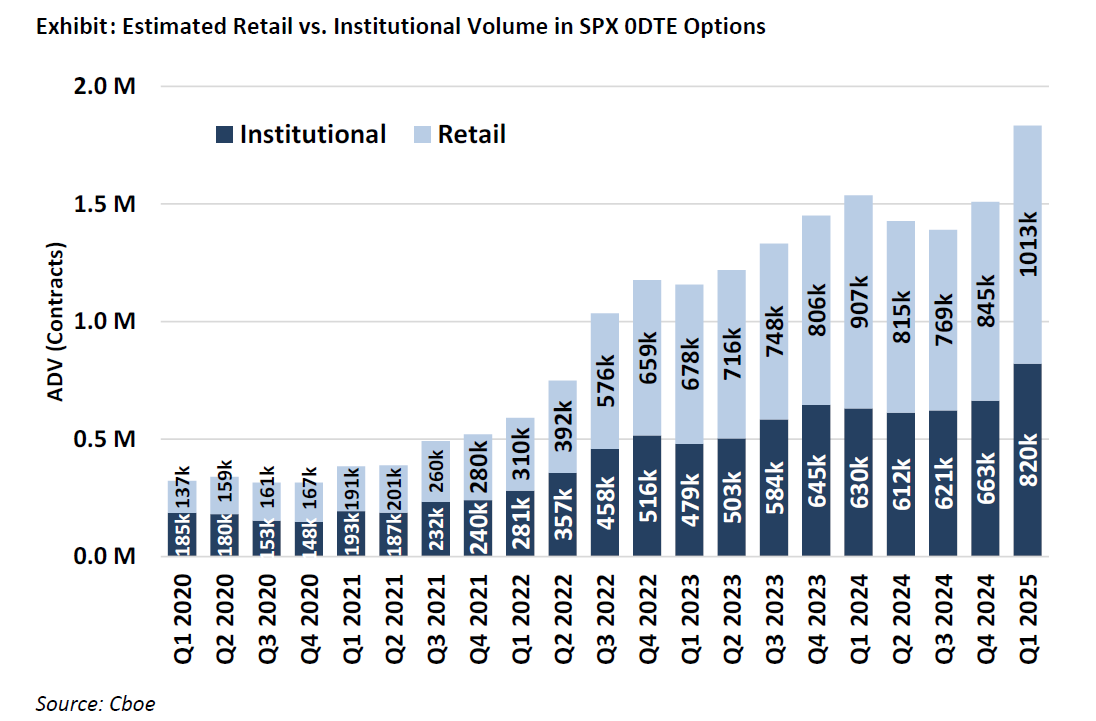

Options activity continues to set new records, particularly in same‑day SPX expiries, which amplifies these flows and makes day‑to‑day moves feel disconnected from headlines.

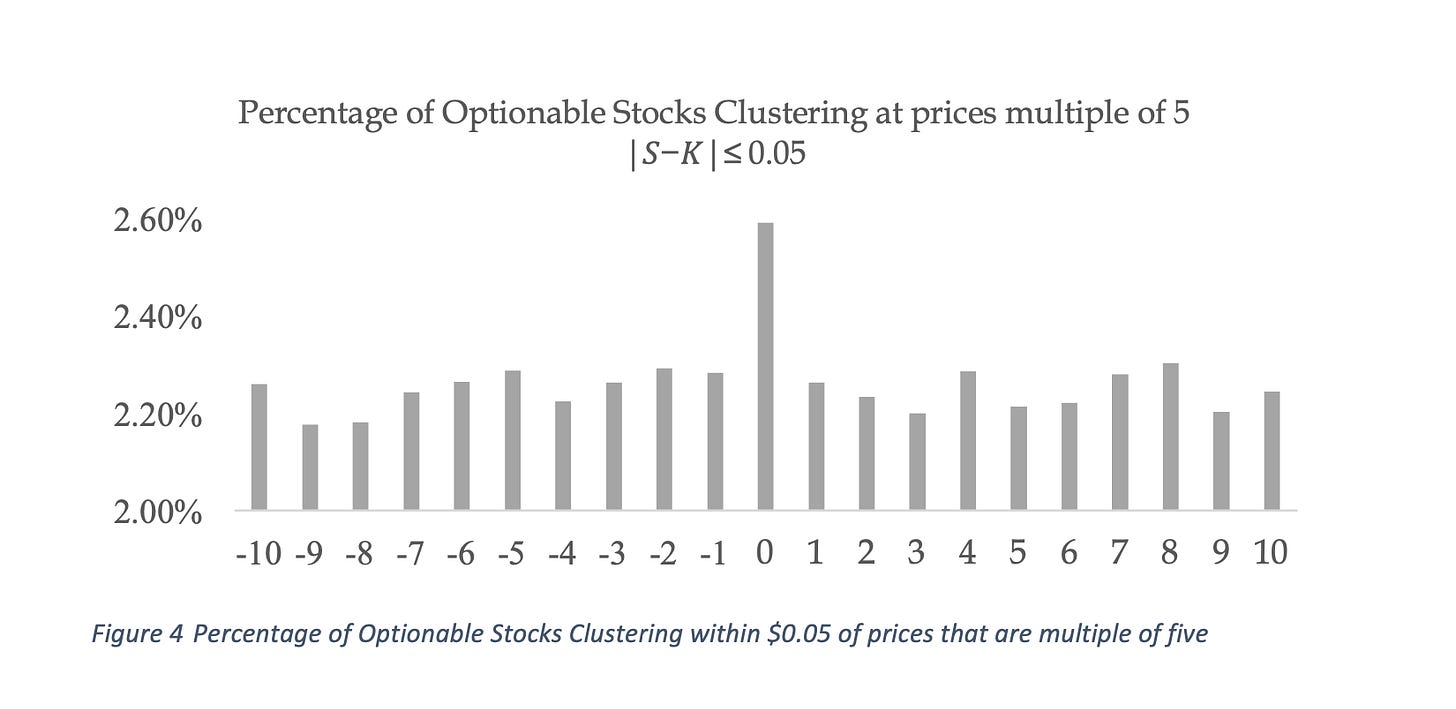

This isn’t just theory. Years ago, I ran a study with 5 years of data ending in 2014, and documented an abnormal tendency for stocks to “pin” at strikes on OPEX days. The pattern has only grown more pronounced as options volume exploded. Think of that pin as the cat’s tail poking out from under the couch—evidence of a larger creature shaping the visible market. One thing is clear - the bigger the derivatives market the bigger it’s influence in the underlying behaviour.

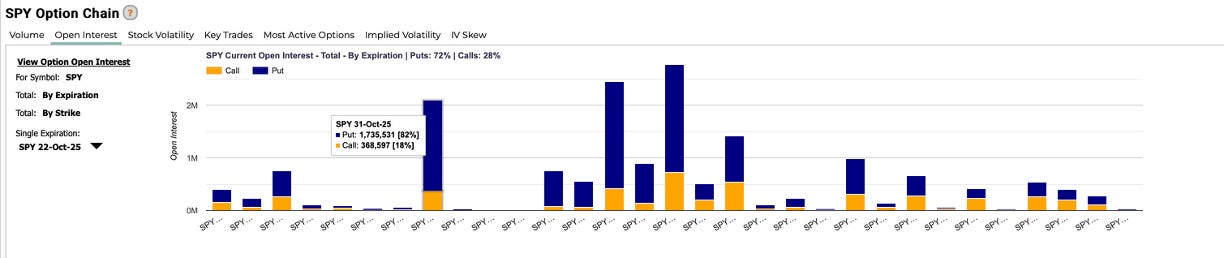

Additionally, even when a date isn’t a classic OPEX, a surge in protective positioning can create a synthetic OPEX. Recently we saw this ahead of an announced tariff threat with effective date around November 1st. Consequently, heavy put buying expiring in October 31st produced OPEX‑like pressures despite not being a 3rd friday of the month.

However, as 0DTE SPX options continue to gain popularity, the impact of synthetic OpEx deserves more attention. This relatively new dynamic, in my view, is distorting price discovery on a daily basis with notional daily trading amounts in the SPX alone reaching over 1.5 Trillion $ daily.

A situation similar to what we’ve seen in India with Jane Street will likely emerge in other parts of the world as well. We’ll cover that in a future post.

2) Leverage is at records while Risk Premium close to the Lowest

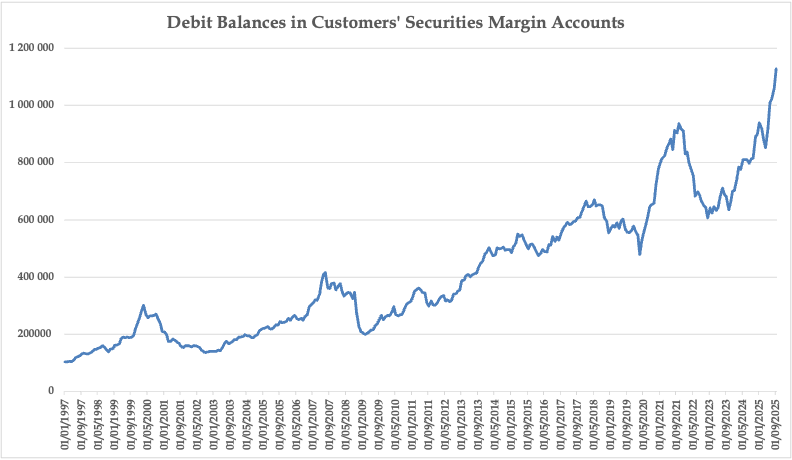

In the U.S., customer margin balances are near record territory (just below $1.2 trillion), with brokers reporting tens of billions against their own books.

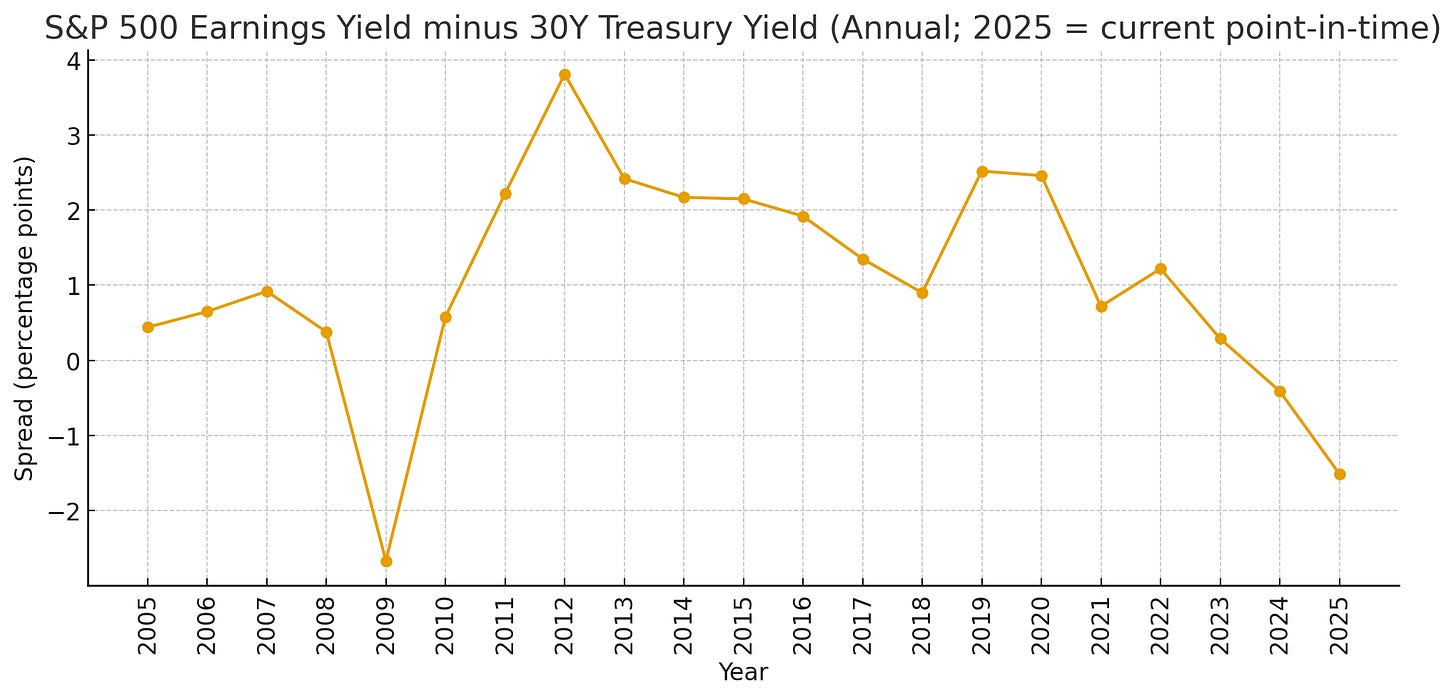

It feels almost counterintuitive that leverage today is significantly higher than in 2021—when interest rates were near zero—especially as markets sit at record valuations and SP500 risk premium now hover near their lowest levels since 2009.

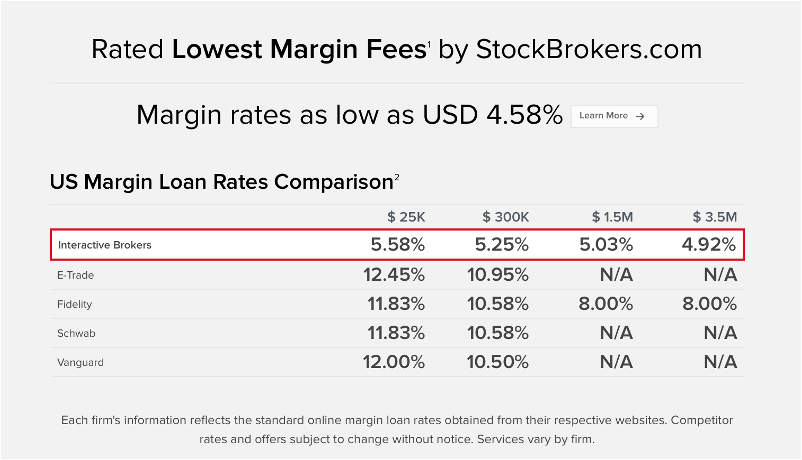

At an illustrative ~11% annual cost of margin, any leveraged position needs to clear a real hurdle just to break even. Simply put, if you buy AAPL stock using a loan with an 11% interest rate, the stock needs to return at least 11% a year just for you to break even on the trade.

If market returns slow down while financing costs stay elevated, the incentive flips from “add leverage” to “de‑leverage”.

However, there’s another perspective to consider — if market returns begin to lag behind those of other global markets, we could see a major rotation. With leverage at all-time highs, whether through margin or derivatives, investors may eventually be forced to sell — and the exit door might prove far too narrow.

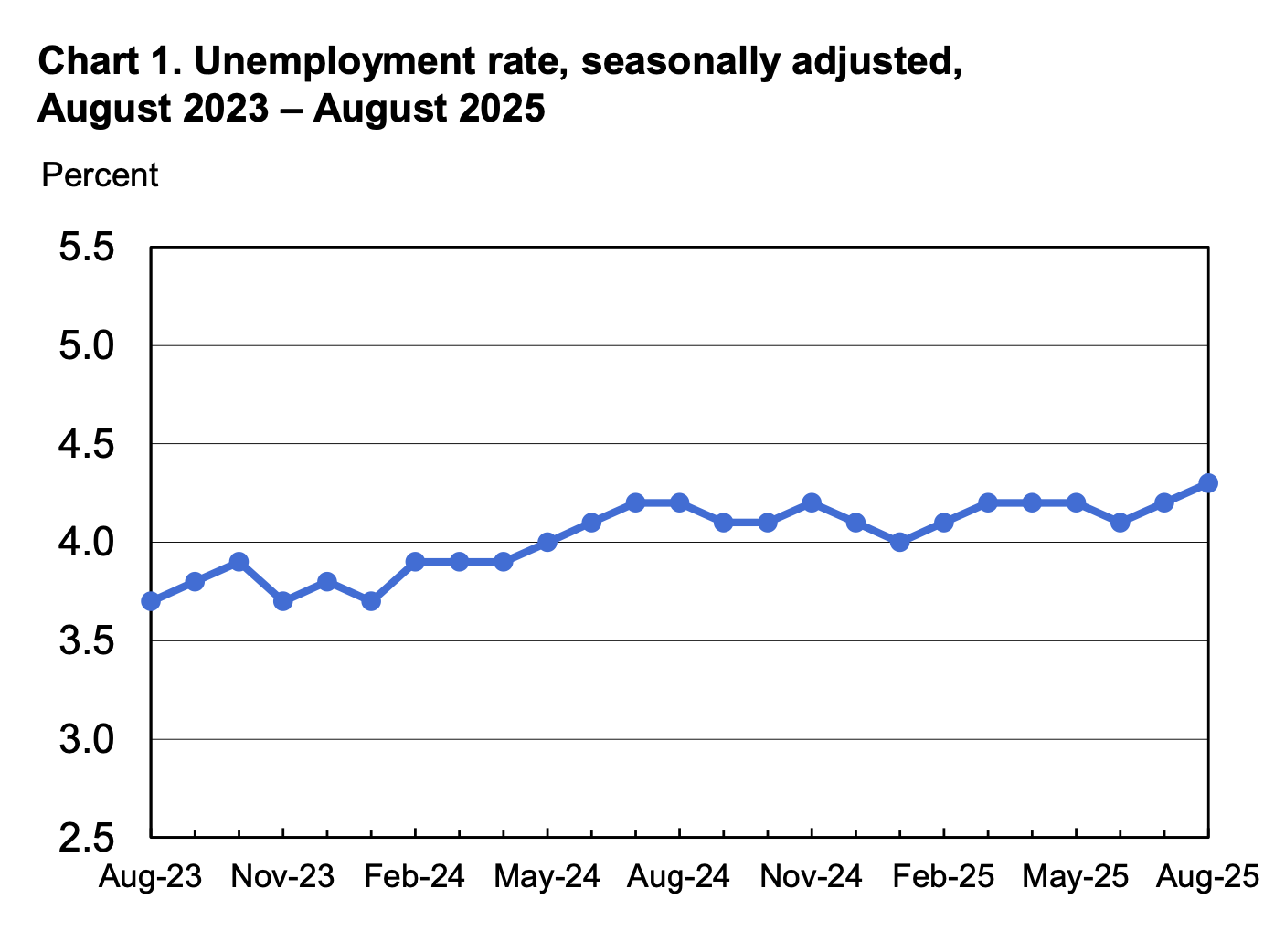

Additionally, some investors choose to borrow directly against their portfolios through broker-issued margin loans rather than sell appreciated positions and trigger taxes. On an individual level, this can make sense if you believe your short-term cash needs are temporary. However, if a recession hits or the job market weakens for longer than expected — and a large number of investors are doing the same — it could end up adding fuel to the fire, intensifying the sell-off and amplifying the feedback loop.

The government shutdown is obscuring our view of the latest employment data, but several indicators are already flashing red. We’ll dive deeper into this in the next post.

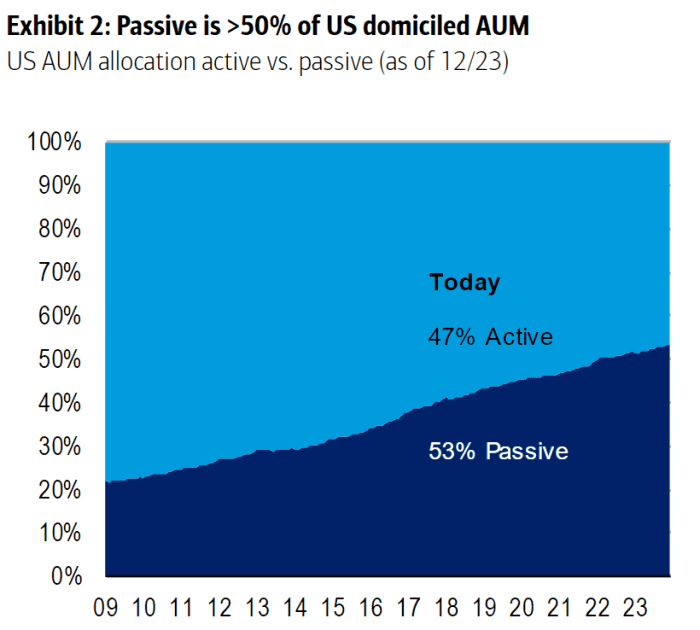

To wrap up, we can also add the global rise of passive investing. Which could lead to potentially disorderly unwind and affect price discovery, especially if we see a significant slowdown in the U.S. and European economies.

Many have warned about the risks tied to the rise of passive investing, particularly how it can drive large moves in mega-cap stocks even on relatively thin volume. As more market participants become numb to news through passive exposure, the share of active investors contributing to price discovery after new information declines sharply. At the same time, the pool of available shares also contracts, amplifying volatility and price impact of changes in demand.

In conclusion, a global economic slowdown could trigger a sharp correction just as the global shift toward passive strategies has fuelled one of the strongest bull runs in the S&P 500’s history.

3) The volatility paradox: outsourcing conviction to “the market” can be costly

When prices quietly grind higher for long enough, investors start outsourcing their due diligence to the market. In other words, if the market keeps rising, it must mean everything’s fine.

But as economist Hyman Minsky proposed, the market is fundamentally unstable. His theory suggests that periods of stability sow the seeds of their own destruction, as a sense of safety encourages ever-greater risk-taking — until that very risk-taking breeds instability, panic, and crisis.

“Stability leads to instability. The more stable things become and the longer things are stable, the more unstable they will be when the crisis hits.”

- Hyman Minsky

The issue with outsourcing your worldview to the markets is that the same reflexive mechanics I mentioned earlier can distort your perception of reality. It’s not uncommon to see high-confidence, high-volume “80%-plus” probabilities collapse to zero overnight. All because the signal you trusted wasn’t truly independent from the very flows you chose to ignore.

Imagine walking down a street lined with restaurants. One of them has a long queue outside, so you assume it must be the best. Without realizing it, you’ve outsourced your judgment to “market-based recognition.” But that line might be misleading — maybe the restaurant is small, maybe it’s paying people to stand outside, or maybe it’s deliberately creating scarcity to signal popularity.

The same thing happens in markets. When everyone assumes the crowd must know something, individual due diligence fades. Price action becomes the queue — and when enough people start following it blindly, perception detaches from reality.

4) We will all be Trading Debt soon

Donald Trump recently suggested that the U.S. could pay down its national debt using cryptocurrencies. Most people dismiss it, but I believe stablecoins will definitely play a role in this.

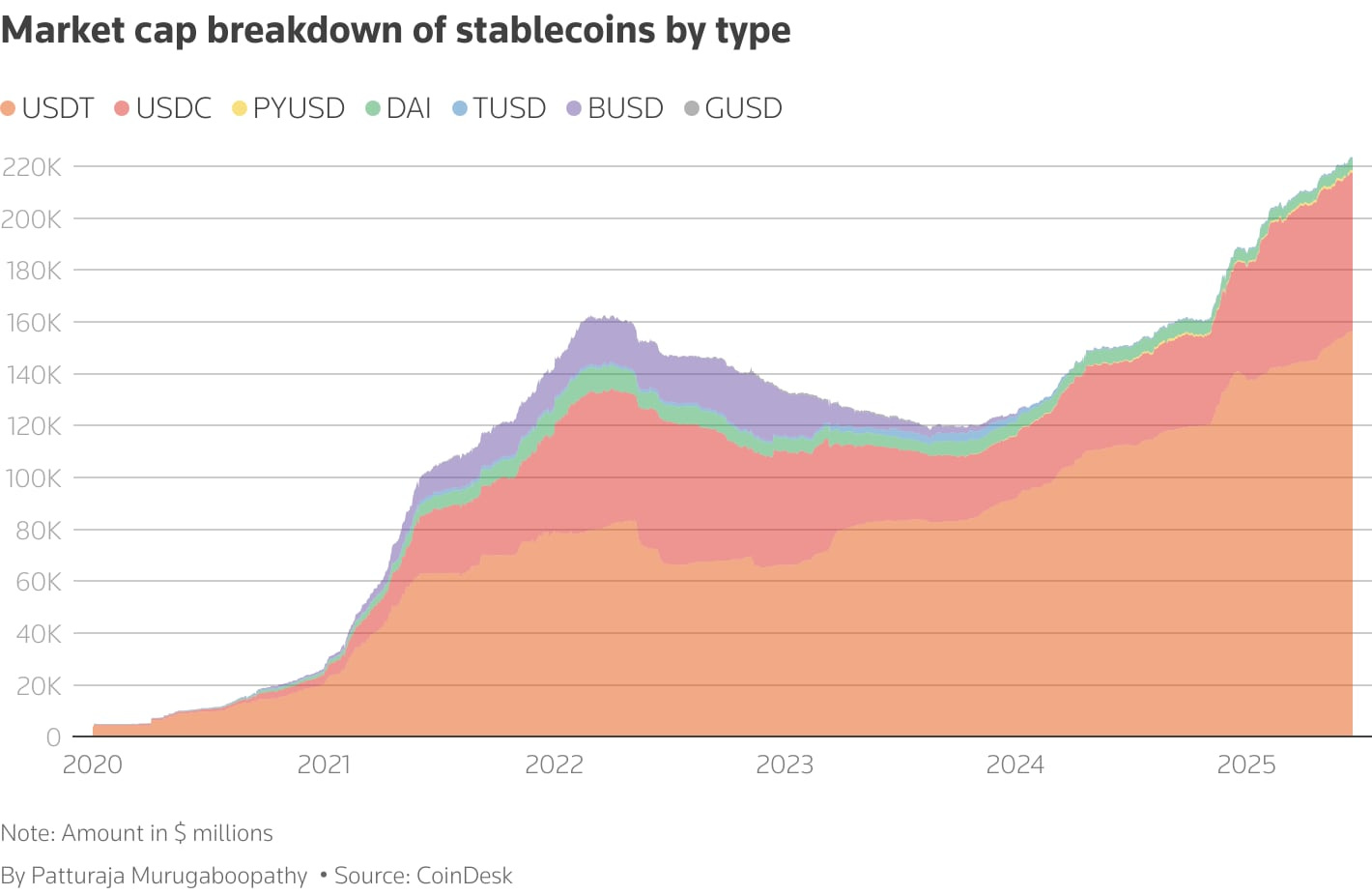

I expect the U.S. to lean into Treasury-backed dollar stablecoins as a tool to recapture and govern the offshore dollar system.

With the passing of the GENIUS Act, only permitted payment stablecoin issuers can operate and they must hold 1:1 reserves in high-quality liquid assets (including short-term U.S. Treasuries) in exchange for each token issued.

In effect, every USDC/USDT used in day-to-day commerce becomes a claim on that reserve pool. Effectively, a transferable slice of U.S. debt-backed value, or “Treasuries in your wallet.”

However, unlike the unregulated eurodollar market, these stablecoins can be frozen or blocked by their issuers. Both USDT and USDC protocols include administrative functions that allow issuers to lock or blacklist specific wallets if they suspect illicit activity. Over time, this capability could give the U.S. government de facto control over the offshore dollar system, enabling it to restrict or freeze stablecoins held in jurisdictions that fall outside its geopolitical alignment.

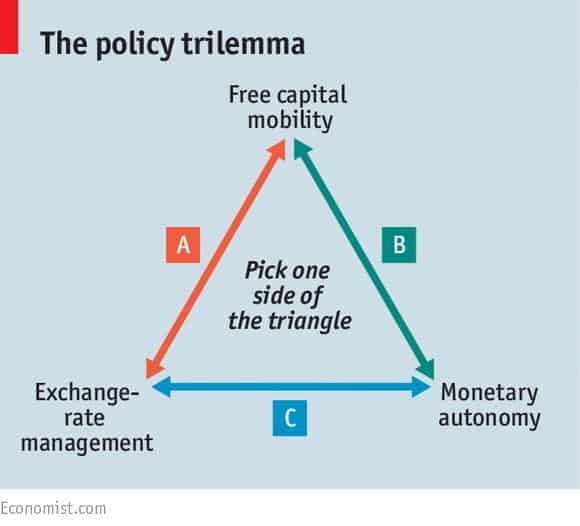

The Chinese monetary trilemma underscores why the U.S. has a vested interest in overseeing the flow of dollars in offshore markets. China effectively manages a soft peg between the yuan and the U.S. dollar, maintained through the People’s Bank of China’s (PBOC) vast holdings of dollar reserves.

This arrangement allows China to run large domestic credit expansions and fiscal deficits in yuan without triggering a sharp currency devaluation, as long as capital controls remain tight and markets cannot freely “attack” the yuan.

In practice, this means the Chinese government can subsidise manufacturing in Yuan and sell goods abroad for foreign currency and then recycle those proceeds into its foreign-exchange reserves. It’s a system that sustains China’s manufacturing engine while deepening its strategic leverage and it’s also one of the reasons why tariffs are not very effective against China.

From a U.S. perspective, stablecoins represent a way to reassert oversight and influence over these offshore dollar circuits, potentially re-anchoring the system under U.S. regulatory reach.

I expect a push to standardize issuance, backing, and custody, plus soft‑power incentives that nudge cross‑border trade to settle in compliant stablecoins: a U.S. firm paying an Asian supplier in USDC or an European importer paying an American exporter in USDT, and so on.

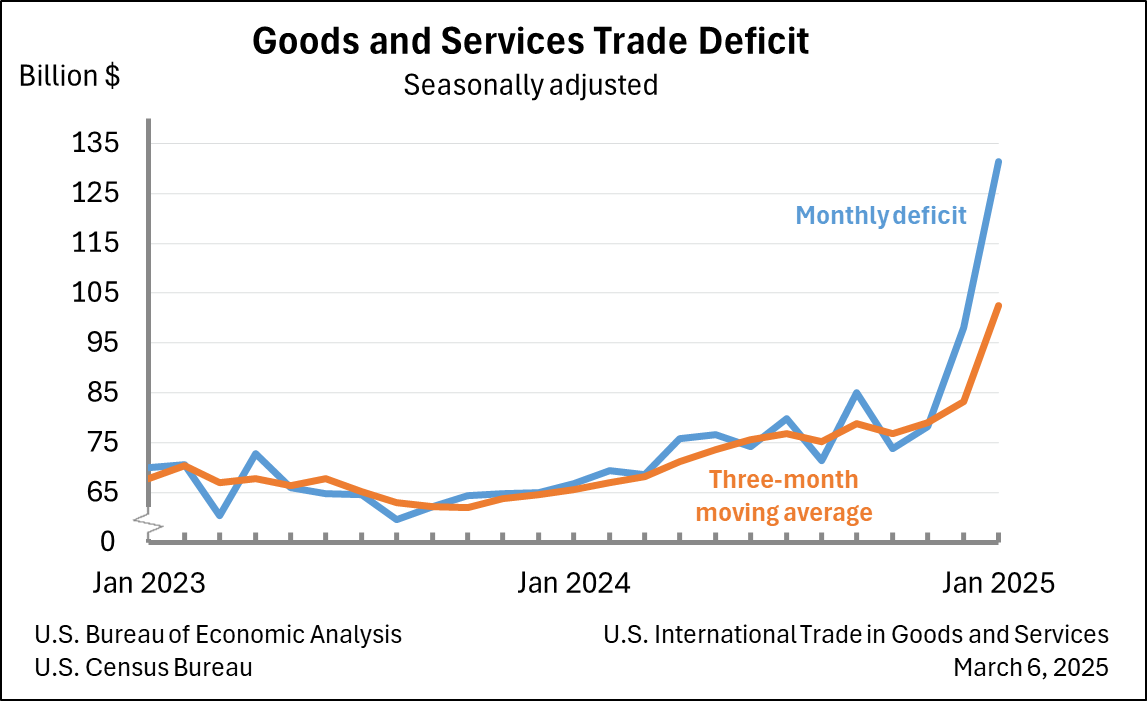

If the current balance of trade remains consistent with historical trends, I believe the U.S. will be able to “export” U.S.-backed stablecoins at a rapid pace once they begin to play a formal role in global trade and cross-border payments.

While the official pitch will be speed, transparency and settlement the strategic effect is jurisdictional reach over dollar liquidity abroad.

If this thesis is right, reserve‑currency “privileges” morph rather than disappear. Over time, I expect this to weigh on the broad dollar and support the euro at the margin, as Europe will likely move more cautiously toward full stablecoinization, offering an alternative path for global allocators.

I believe Russia and China have already recognized this shift. Their reduction in U.S. Treasury holdings and increased accumulation of gold appear to be part of the broader Game Theory strategy unfolding in the global currency wars.

5) “We are in a Bubble, Do not Short it, Do not Own it”

We’ve heard plenty of voices warning about a potential bubble. One of the main arguments is that valuations look stretched. On the other hand, some people argue that it’s partly a denominator issue. Everyone seems to be riding on the debasement of the U.S. dollar, and, by extension, most other major currencies around the world.

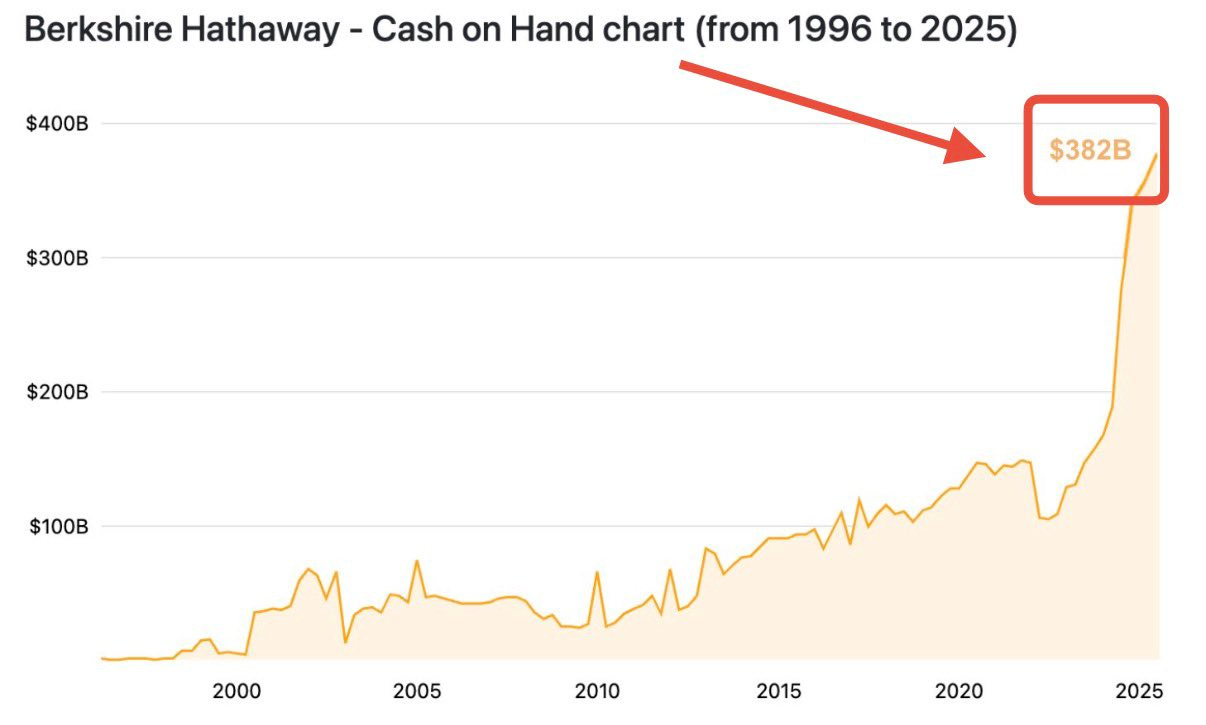

However, several prominent investors — including Warren Buffett and Michael Burry — have been voicing concerns and scaling back their market exposure. Buffett’s Berkshire Hathaway has continued its streak of net selling and now holds more than $382 billion in cash and short-term Treasuries.

Additionally, Michael Burry recently shared an interesting post on X, essentially suggesting that the smartest move right now might be not to play the market’s game of hot potato. It’s not hard to see why, by most measures we’re likely in bubble territory. However the hardest part is not recognising the bubble, but timing its collapse. In that sense, stepping back and looking for returns elsewhere might be the most rational move.

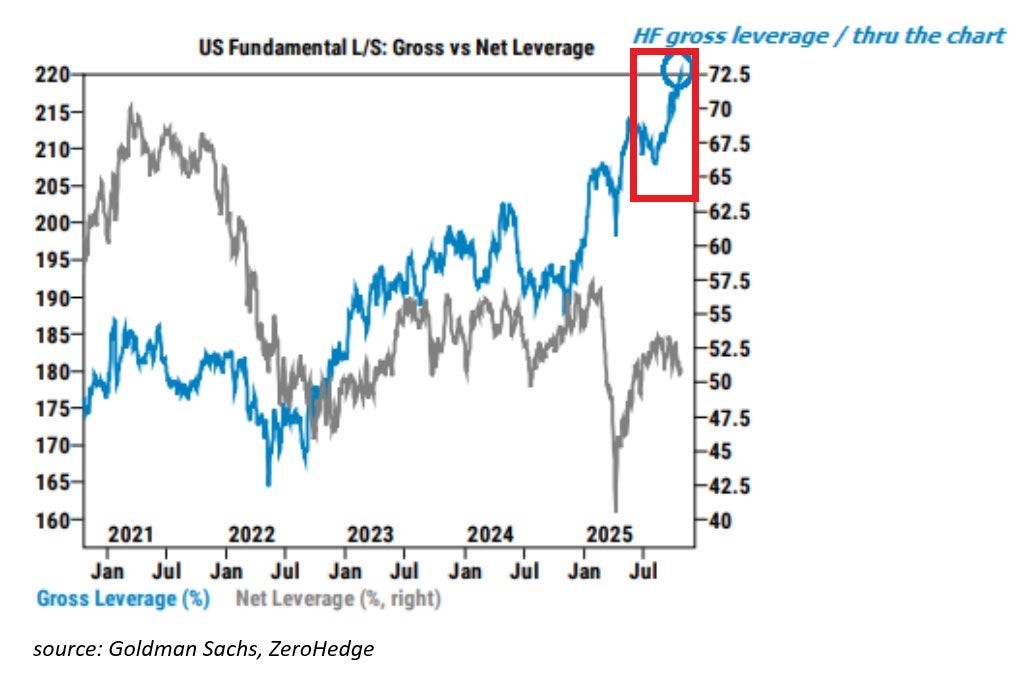

One way to look elsewhere for returns could be in emerging markets, as I believe we’re likely entering another commodity upcycle. Alternatively, less conventional approaches—such as fundamental long/short strategies—may outperform. The growing reflexivity driven by both passive flows and leveraged derivatives could, in fact, create fertile ground for relative-value strategies to thrive.

If you’re interested in learning more about these strategies, visit TradingLongShort.com — or, if you’re Portuguese, check out jpfinancas.pt for additional insights and resources on these topics.

To wrap up..

Market conditions today are increasingly shaped by reflexivity and leverage, rather than fundamentals. Short-term price action is dominated by derivative flows—especially 0DTE SPX options—that create “synthetic” expiration effects and distort daily price discovery. Leverage is sitting near record levels, even as risk premiums hover close to post-2009 lows, meaning investors are paying more for less reward while borrowing costs are still high.

Meanwhile, the explosive growth of passive investing has dulled market responsiveness to new information. This creates a setup where the smallest shift in positioning could lead to a disorderly unwind—especially if the U.S. or European economies slow more sharply than expected. In effect, investors are outsourcing conviction to the crowd, trusting “market-based recognition” rather than genuine due diligence, which echoes Hyman Minsky’s timeless warning that long periods of stability inevitably sow the seeds of instability.

Beneath the surface, the macro and geopolitical layers are just as important. The passage of the GENIUS Act has pushed U.S.-issued stablecoins like USDC and USDT to short-term Treasuries, effectively turning them into on-chain extensions of U.S. debt—a strategic lever for Washington to re-assert oversight over offshore dollar liquidity.

This shift contrasts sharply with China’s managed yuan peg, which relies on vast dollar reserves to sustain domestic credit expansion and export competitiveness. As these two systems evolve, digital dollars could become a new arena for monetary influence.

For investors, this changing landscape favors selectivity over participation: fundamental long/short and relative-value strategies may thrive amid the dynamics previously mentioned, while emerging markets—particularly commodity-linked economies—could lead the next cycle. In such an environment, recognising the bubble is easy, timing its burst is not. Sometimes, as Michael Burry implied, the smartest move is to step aside.