Change in Monetary System is Inevitable

As access narrows and inequality widens, a dual-currency future begins to take shape

Hello everyone,

Here we are for another article!

In last week’s article, we covered several key topics. We discussed how rising volatility could hinder the reemergence of the Carry Trade and how double taxation treaties might serve as an additional tool to control capital flows. We also explored the growing economic asymmetries and the types of opportunities that could emerge as a result, particularly in US and EU listed stocks. Finally, we touched on the renewable energy sector, where I believe compelling opportunities are beginning to take shape.

Since Trump announced plans to end the 30% residential solar tax credit by the end of 2025—part of what he called the “big beautiful bill”—solar stocks have seen a significant rebound.

Last week, I came across a short segment from Bessent that potentially confirms a shift in double taxation agreements, aimed at reducing net yields or limiting access for foreign investors.

The most notable part begins at minute 22:00 of the video, where he essentially explains that U.S. dollars held overseas were once used primarily to purchase American goods—but are now being funnelled into assets like Treasuries, private equity, or “Google Stock”.

In a world increasingly defined by currency debasement, I believe access to “cloud capital” and productive assets—especially in nations like the U.S.—will become progressively more restricted. As I highlighted in my previous article, we’re in need of a new denominator in the AI era.

Bitcoin is undoubtedly one of the leading contenders, but it’s likely we’ll see a diverse mix of stablecoins, CBDCs, and other cryptocurrencies emerge. I expect the monetary system to become significantly more complex in the coming years.

The strategic adoption of Bitcoin by publicly traded companies highlights its unique role in supporting the energy transition. Bitcoin fits seamlessly into this shift—not only by acting as a flexible load to help stabilise the grid, but also by enhancing the economic viability of renewable energy projects through curtailment mitigation.

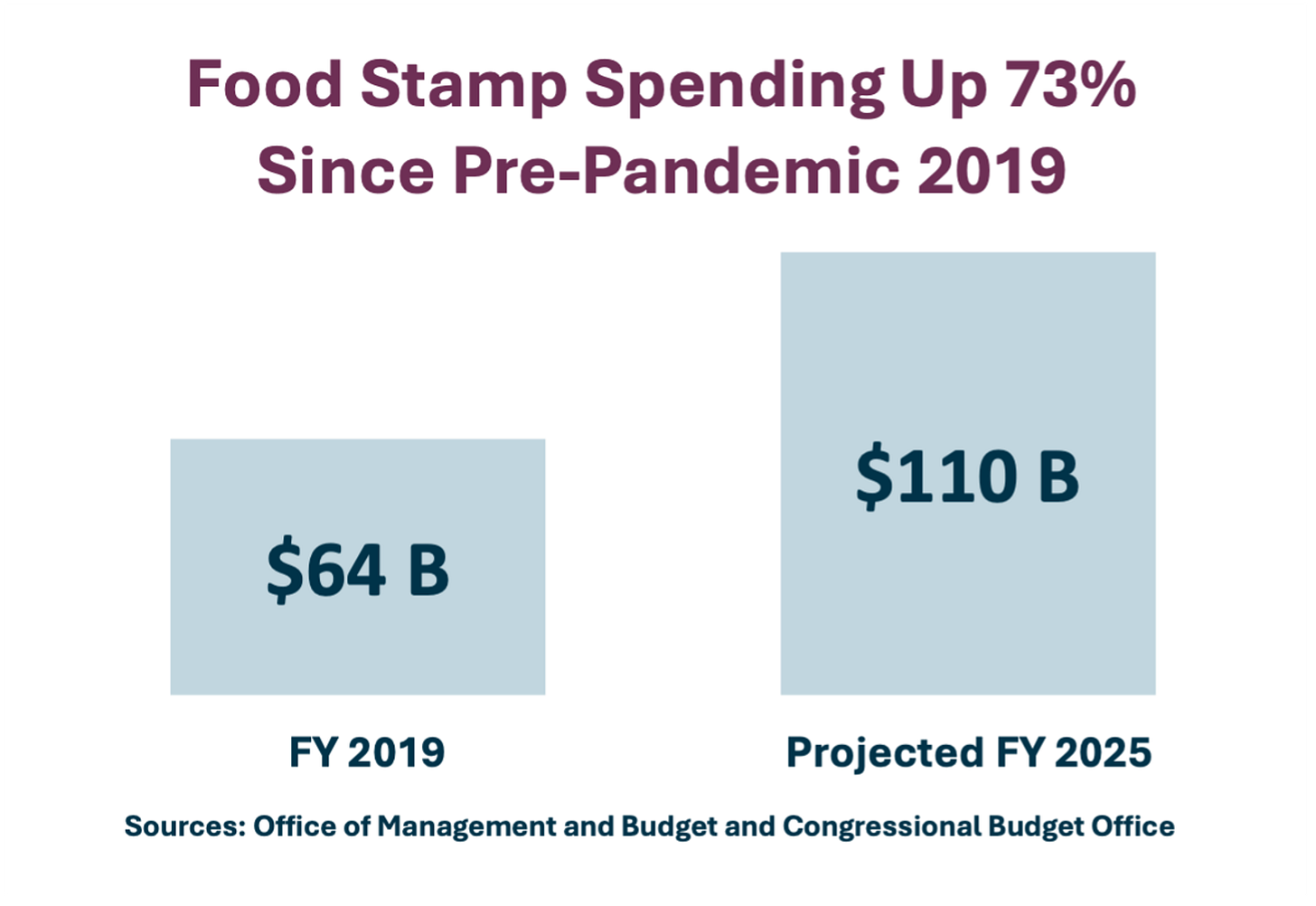

I find it interesting to view food stamps as a kind of alternative currency within the U.S. economy. At their core, they function as restricted-use vouchers: a government-issued medium of exchange that allows recipients to acquire a specific category of goods—namely, food—but nothing beyond that.

This model reflects a broader societal shift. As technological advances, especially in AI and automation, reduce the number of ways individuals can economically differentiate themselves or contribute meaningfully to the labor market, traditional income-based compensation becomes less accessible for many.

As a result, we may be heading toward a bifurcated economic system—where productive individuals or those who own significant capital and means of production transact in a relatively “hard” or tight monetary currency, while those without capital or the ability to economically differentiate themselves increasingly rely on parallel systems of restricted or conditional value, such as food stamps or other forms of government-administered support.

I believe this trend is only set to intensify across multiple fronts, ultimately forcing a structural shift in the global financial system. We're witnessing a convergence of rising taxation, increasing barriers to accessing developed capital markets, and the introduction of access fees—developments that collectively reshape how capital flows globally.

In a recent interview with Lex Fridman, Google’s CEO noted that while we may still fall slightly short of achieving AGI by 2030, the impact of AI by that time will be profound. He emphasised that we should expect both positive and negative externalities—challenges and opportunities society will need to actively navigate.

Against this backdrop, the notion of a 50% drop in asset values when denominated in USD seems increasingly implausible. The monetary system is evolving in a way that may preserve nominal asset values, even if real value erodes beneath the surface.

Despite slowing global growth, record-high sovereign debt levels and high interest rates—we’re seeing all-time or close to all-time highs in both gold and equity markets, underscoring the deep uncertainty surrounding fiat stability and the future of traditional monetary policy.

Next week, we'll continue exploring some of these ideas in greater depth.

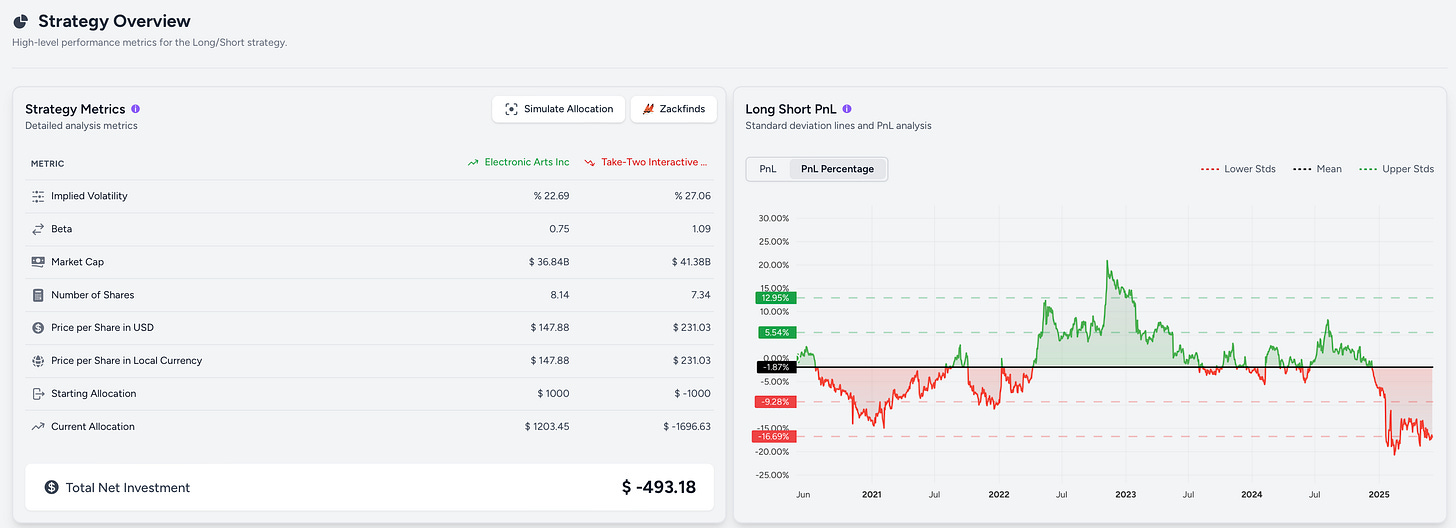

To wrap up - there might be an interesting setup for a Long Short Between EA 0.00%↑ and TTWO 0.00%↑. I wrote an article at TradingLongShort.com and if you’d like to explore the platform, there’s a free trial available—plus, Gold Subscribers can enjoy a 40% discount using the code SUMMER-GOLD.