13 days to OpEx

In a prior article, I articulated my perspective on the potential market response subsequent to the failure of SVB.

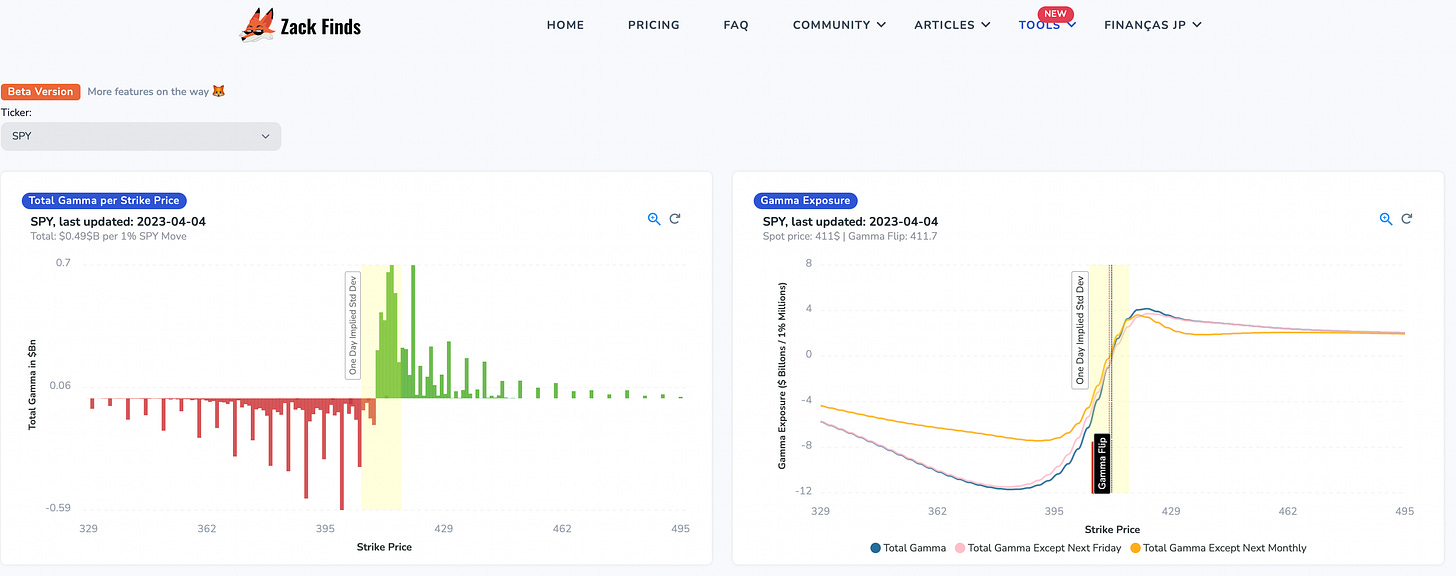

“Well, according to ZackFinds.io, at the beginning of the trading day on Friday, SP500 gamma positioning was in the percentile 100. Bottom line: there is too much hedging in the market with a relatively high IV when compared to the beginning of the week.

(…)

“However, going into OpEx, these flows should be extremely supportive with Charm and Vanna flows pushing/supporting the market.”

Currently, we are 10 days beyond the March OpEx, and with the April OpEx just over two weeks away. Has my perspective altered since the publication of my previous article?

In essence, my position remains unchanged. I maintain that the market is largely experiencing the supporting effects of hedging flows reflexively. However, I did underestimate the duration of the unwinding process and the magnitude of short-term hedging, even after the OpEx. Additionally, I did not accurately anticipate the extent of liquidation and/or closing of put positions and short sellers associated with the capitulation induced by the market's surge. A similar scenario happened at the end of February 2022, when the market experienced extreme fear regarding the ramifications of a war in Europe, and agents were excessively hedged, leading to the market rallying over 15% in a month.

In my opinion, what we are observing presently is comparable to February 2022 in terms of positioning, with the market being sustained predominantly by technical factors.

Oil

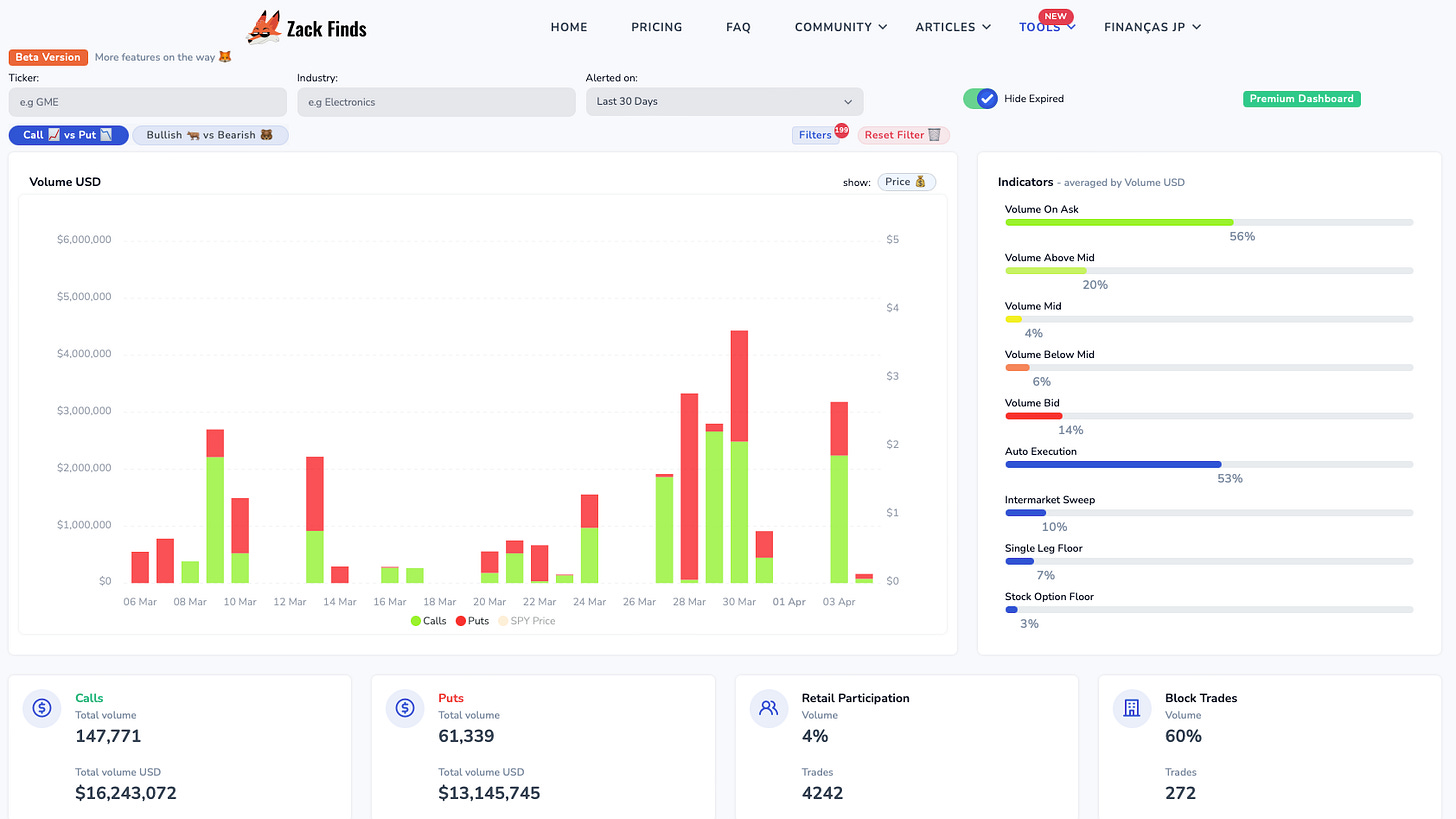

As anticipated, the interventions enacted by the US and the EU to backstop a banking crisis have influenced energy prices. This is evidenced by the decision of net exporters to curtail production during the most recent OPEC meeting. Additionally, in the last month, there has been a notable surge in unusual Call option activity among Oil & Gas listed companies, with block trades constituting the majority of such transactions.

I wrote a small article last week where I laid out briefly why a pause in normalisation of monetary policy could lead to reduced output by net energy exporters.

“The decision to pause the normalization of conventional and non-conventional monetary policy at this point would result in a loss of external credibility. This, in turn, would likely lead to a reduction in output of net energy exporters and cause prices to rise.”

Come Back of Energy Prices in 2023

NVDA & TSLA

Similarly to the circumstances observed with the SP500, both TSLA 0.00%↑ and NVDA 0.00%↑ are exceedingly vulnerable to option dynamics. My viewpoint remains consistent with that outlined in the article linked below:

If you found this article informative, please consider sharing it with others who may also benefit from this insight. Additionally, subscribing to our newsletter will ensure that you stay updated with the latest news and analysis in the financial world.